NXP_SEMICONDUCTORS_NXPI Earningcall Transcript Of Q2 of 2024

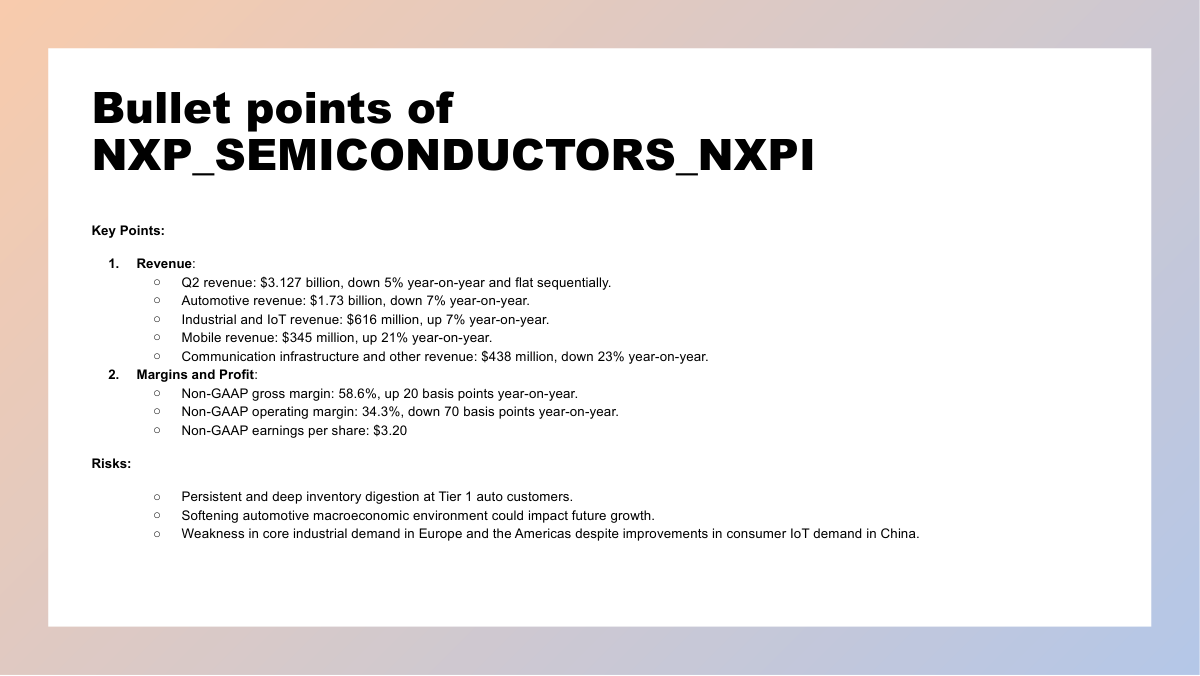

William J. Betz -- Chief Financial Officer Thank you, Kurt, and good morning to everyone on today's call. As Kurt has already covered the drivers of the revenue during Q2 and provided our revenue outlook for Q3, I will move to the financial highlights. Overall, the Q2 financial performance was good. Revenue, non-GAAP gross margin, operating expenses, and distribution channel inventory all came in line with our guidance. Turning to Q2 specifics, total revenue was $3.127 billion, down 5% year-on-year. We generated $1.83 billion in non-GAAP gross profit and reported a non-GAAP gross margin of 58.6%, up 20 basis points year-on-year, and 10 basis points above the midpoint of our guidance range. Total non-GAAP operating expenses were $760 million, or 24.3% of the revenue, down $11 million year-on-year. This was $5 million below the midpoint of our guidance due to lower than anticipated hiring. From a total operating profit perspective, non-GAAP operating profit was $1.07 billion, and non-GAAP operating margin was 34.3%, down 70 basis points year-on-year, and up 30 basis points above the midpoint of our guidance. Non-GAAP interest expense was $67 million, with taxes for ongoing operations of $169 million, or a 16.8% non-GAAP effective tax rate. Non-controlling interest was $6 million, and stock-based compensation, which is not included in our non-GAAP earnings, was $114 million. Taken together, we delivered non-GAAP earnings per share of $3.20, consistent with our guidance. Now, I would like to turn to the changes in our cash and debt. Our total debt at the end of Q2 was $10.18 billion, with our cash balance of $3.26 billion, down $49 million sequentially, due to the cumulative effect of capital returns, capex investments, and cash generation during Q2. The resulting net debt was $6.92 billion, and we exited the quarter with a trailing 12-month adjusted EBITDA of $5.3 billion. Our ratio of net debt to trailing 12-month adjusted EBITDA at the end of Q2 was 1.3 times, and our 12-month adjusted EBITDA interest coverage ratio was 23.1 times. During Q2, we paid $260 million in cash dividends and repurchased 310 million of our shares. Taken together, we returned $570 million to shareholders, representing 99% of non-GAAP free cash flow. After the end of Q2, and through Friday, July 19th, we repurchased an additional $69 million of our shares under an established 10b5-1 program. Turning to working capital metrics, days of inventory was 148 days, an increase of four days sequentially, while distribution channel inventory was 1.7 months, or just over seven weeks. The combination of balance sheet inventory and channel inventory was about 200 days of inventory. Days receivable were 27 days, up one day sequentially, and days payable were 64 days, a decrease of one day versus the prior quarter. Taken together, our cash conversion cycle was 111 days, an increase of six days versus the prior quarter. Cash flow from operations was $761 million, and net capex was $184 million, or 6% of revenue, resulting in non-GAAP free cash flow of $577 million, or about 18% of revenue. Turning to our expectations for the third quarter, as Kurt mentioned, we anticipate Q3 revenue to be $3.25 billion, plus or minus about $100 million. At the midpoint, this is down 5% year-on-year and up 4% sequentially. We expect non-GAAP gross margin to be about 58.5%, plus or minus 50 basis points. As Kurt noted in his prepared remarks, we will continue to stage inventory in the channel to support growth in future periods. Our guidance assumes approximately 1.8 months of distribution channel inventory exiting Q3. Operating expenses are expected to be $760 million, plus or minus $10 million. Taken together, we see non-GAAP operating margin to be 35.1% at the midpoint. We estimate non-GAAP financial expense to be $67 million, with the non-gap tax rate to be 16.8% of profit before tax. Non-controlling interest and other will be about $9 million. For Q3, we suggest for modeling purposes, you use an average share count of 258.5 million shares. We expect stock-based compensation, which is not included in our non-GAAP guidance, to be $116 million. For capital expenditures, we expect to be around 6%. Taken together, at the midpoint, this implies a non-GAAP earnings per share of $3.42. Before going to my closing remarks, I will provide additional details of the VSMC joint venture, as discussed by Kurt earlier. The total cost of the joint venture will be $7.8 billion. The NXP investment into the venture is $2.8 billion, made up of $1.6 billion commitment for a 40% equity stake in the joint venture, and an additional $1.2 billion investment for long-term capacity access. Vanguard will invest $3.1 billion, made up of $2.4 billion for a 60% equity stake, and an additional $700 million for long-term capacity access. The remainder of the funding will be provided by other sources in the form of subsidies and loan guarantees in Singapore. This joint venture will not consolidate into NXP's financial statements, but the profits and losses will be reflected under the equity accounting investees in our non-GAAP income statement. The investment will be funded from cash flow from ongoing operations, with no need to raise additional debt. Additionally, the joint venture will provide approximately 200 basis points of gross margin expansion to our total corporate gross margin when fully operational in 2029. The gross profit benefit is derived from the incremental revenue, the benefits of the increase to 300 millimeter wafer size, and the avoidance of typical margin stack-in when buying material in the commercial foundry market. So in closing, looking through the remainder of 2024, I would like to highlight three areas of focus. First, with the VSMC and ESMC investments, there is no change to our capital allocation policy. We have returned $2.4 billion, or 81% of the free cash flow generated over the last 12-months. Furthermore, we will continue to be active in the market repurchasing NXP shares. Second, we will continue to be disciplined to manage what is in our control and stay within our long-term financial model. Specifically, we expect our gross margin will continue to perform at or above the high end of the long-term model. And then, lastly, we feel confident to resume sequential growth through the second half while we continue to stage inventory in the channel in a targeted and controlled manner. I would like to now turn it back to the operator for your questions. Questions & Answers: |