LOCKHEED_MARTIN_LMT Earningcall Transcript Of Q2 of 2024

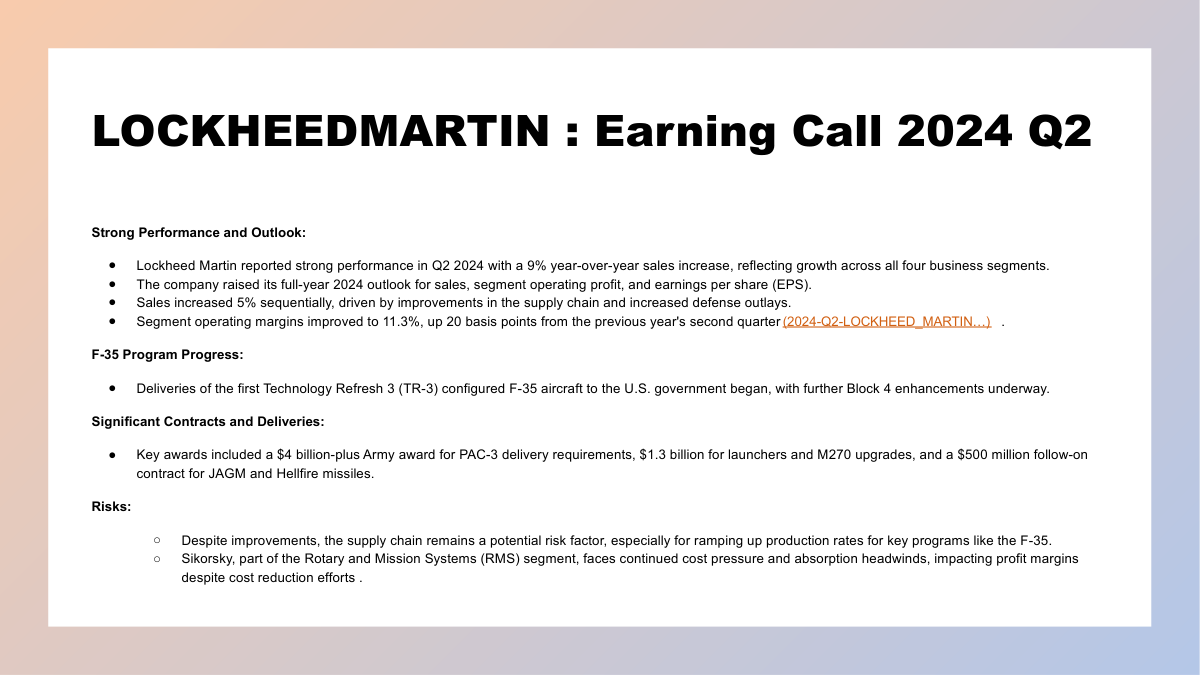

Jesus Malave, Jr. -- Chief Financial Officer Thanks, Jim. Similar to last quarter, I'll provide an overview of consolidated financials and touch on a handful of operational items before handing off to Maria, who will cover business area financials, and then I'll come back to discuss the updated outlook. Starting on Chart 4. The positive momentum we had to begin the year continued into the second quarter with sales up 9% to over $18 billion, led by RMS and MFC. As Jim mentioned, throughput remained strong reflecting an improving supply chain and internal operating cadence. Segment operating profit of $2 billion was up 10% year over year, and consolidated margins were 11.3%. With all four business areas achieving double-digit return on sales, the first time since the third quarter of 2022. Net favorable profit adjustments in the quarter were higher than prior year and were 21% of segment operating profit, driving the stronger margins. GAAP earnings per share of $6.85 increased 3% year over year, driven by higher profit and lower share count, partially offset by severance impairment charges at RMS and Sikorsky, higher interest expense, and lower pension income. On the new business front, we recorded over $17 billion of orders in the second quarter for a book-to-bill ratio just below one. We generated $1.5 billion of free cash flow in the quarter, bringing our year-to-date total to just under $2.8 billion, and we continue to make the necessary investments in innovation and infrastructure to position the company and our customers for future success with $400 million -- $405 million in research and development and $370 million in capital expenditures the second quarter. Finally, we returned over 100% of our free cash flow to shareholders via share repurchases and dividends. Now, I'll touch on a few business activities in more detail. The order strength continued at MFC with a book-to-bill over two in the quarter, led by the $4 billion-plus Army award spanning multiyear PAC-3 delivery requirements and supporting our production ramp projections. And Poland officials signed a letter of acceptance to purchase 400 JASSM ERs, the largest international order and program history, providing another ally with the latest generation JASSM variant. At Sikorsky, its platforms remain in high demand as the U.S. State Department announced approval for four foreign military sales of Black Hawk to Austria, Brazil, and Sweden. This opens the door to the potential sale of 36 Black Hawks, adding 12 helicopters each to each country's existing Blackhawk fleet. In addition, the government of Greece signed a letter of offer and acceptance for 35 UH-60M Black Hawk helicopters. These upgraded aircraft will support the Hellenic Ministry of Defense's ongoing modernization. It will serve as a dependable multi-role helicopter with unmatched interoperability to support vital national and allied security missions. In the space domain, late last month, NASA selected Lockheed Martin to develop and build the nation's next-generation weather satellite constellation for NOAA known as Geostationary Extended Observations, or GeoXO. This award builds on our prior work with environmental sensing technologies, which recently culminated with the launch of GOES-U, which will leverage advanced instruments and rapid updates to provide crucial data for weather forecasting, severe storm tracking, and climate monitoring. Let me stop here and hand it over to Maria to get into the business area of financial detail. Maria Ricciardone -- Vice President, Treasurer, and Investor Relations Thanks, Jay. Today, I'll discuss second-quarter year-over-year results for the business areas, starting with Aeronautics on Chart 5. Second-quarter sales at Aero were up 6% year over year. The increase was primarily due to higher volumes across F-35 and the continued production ramp on the F-16 program. Segment operating profit increased 5% with higher volume and favorable mix being offset by lower profit booking rate adjustments. Regarding aircraft deliveries, we resumed F-35 deliveries in Q3, as Jim shared, and we've delivered our 1,000 F-35s. On F-16, we delivered four in the second quarter and are targeting around 20 for the year. For 130J, we delivered five in the quarter, reaching a milestone of 2,700 deliveries of this critical tactical airlifter, and expect around 20 deliveries for this year. Turning to Missiles and Fire Control on Chart 6. MFC had another strong quarter with sales up 13% from the prior year, driven by production ramps on a handful of our precision fires programs within the tactical and strike missile segment, primarily Guided Multiple Launch Rocket System, GMLRS, and Long Range Anti-Ship Missile, LRASM. Segment operating profit increased 21% year over year due to higher profit booking rate adjustments led by the PAC-3 and Apache programs margins returned to 14.5%, which is more in line with historical rates. MFC backlog reached a record level of almost $35 billion in Q2 supported by continued global demand for several of our missile ammunition programs. Key awards included the PAC-3 award that Jay mentioned as well as $1.3 billion in combined awards for launchers, including HIMARS, and M270 upgrades, and a $500 million follow-on production contract for JAGM and Hellfire to support U.S. and international customers. On the delivery front, I'll highlight a few of the key program quantities in the quarter. We delivered 100 PAC-3 interceptors, more than 2,000 GMLRS rockets, over 2,700 Hellfire missiles, and 11 HIMARS systems. Shifting to rotary emission systems on Chart 7. Sales increased 17% in the quarter to over $4.5 billion primarily driven by higher volume at integrated warfare systems and sensors on radar and laser programs as well as the Canadian Surface Combatant program. Sikorsky programs also saw higher volume led by Black Hawk and CH-53K. Also of note in the quarter, we delivered five S-70 helicopters to international customers, which resulted in about $115 million of revenue on a passage of title POT basis. Operating profit increased 9% year over year due to higher volume, partially offset by lower profit booking rate adjustments. Now, for a brief summary of helicopter deliveries. In addition to the five S-70 helicopters I mentioned, Sikorsky delivered five Black Hawks, four combat rescue helicopters, and one VH-92 Presidential helicopter in the quarter. On the delivery front, a few of the key program quantities in the second quarter, we -- yes, sorry about that. Let's go to space. Finally, with space on Chart 8. Sales increased 1% year over year. The growth was driven by higher volume on strategic and missile defense programs, primarily hypersonics and Fleet Ballistic Missile, FBM. Partially offsetting this growth was lower volume on classified programs and Orion. Operating profit increased 11% compared to Q2 2023, driven by favorable mix and higher profit booking rate adjustments. Now, I'll turn it back over to Jay to wrap up our prepared remarks. Jesus Malave, Jr. -- Chief Financial Officer All right. Thanks, Maria, and let's shift over to the outlook on Chart 9. Given our strong year-to-date performance, sustained back position, and improving visibility into key programs, we're raising our expectations for Lockheed Martin's 2024 financial outlook for sales, segment operating profit, and earnings per share. We're increasing sales by $1.75 billion at the midpoint and tightening the range to $70.5 billion to $71.5 billion. The new midpoint reflects a solid 5% growth from 2023 with increases across all four business areas. We're also increasing segment operating profit expectation based on the higher sales with the new range of $7.35 billion to $7.5 billion and anticipate consolidated segment operating profit margins to remain at 10.5%. Business area margins remained consistent with our prior guidance at Aero and MFC, while RMS is down about 50 basis points at the midpoint and space is up 40 basis points at the midpoint. The RMS reduction is driven by Sikorsky as the business faces continued cost pressure and absorption headwinds, the impact of which have exceeded benefits from its cost reduction programs. Conversely, space is benefiting from solid performance and proactive reduction efforts. Moving to earnings per share on Chart 11. We're increasing the midpoint by $0.35 to $26.35 with a range of $26.10 to $26.60 for the full year. Primary drivers of the change are shown on this chart with increases coming from incremental profit of $0.49 and other below-the-line items of $0.13. Partially offsetting those items are the RMS charges totaling $0.29 and from the severance actions and the asset write-downs taken in the second quarter. As Jim mentioned, we're encouraged by the F-35 delivery restart and continuous progress being made toward delivering full combat capability. We're holding our free cash flow expectation in the range of $6 billion to $6.3 billion, which absorbs a potential unfavorable impact from longer deferrals of final F-35 delivery payments. This is made possible by proactive actions taken across the company to offset these potential headwinds. On the cash deployment side, we still expect over $3 billion of IR&D and capital investments, while the dividend, along with the expected $4 billion of share repurchases, maintain attractive shareholder returns. Lastly, on backlog, we continue to expect backlog to grow in 2024 even with the higher sales outlook, which provides a line of sight to future growth. Before I wrap, I'd like to highlight a few other key assumptions regarding the updated outlook. First, we expect F-35 18/19 to be awarded this year, maintaining program funding and continuity. Second, we continue to expect $325 million of losses on the MFC classified program, of which $100 million has been recognized year to date. And third, this outlook does not assume any pension contributions in 2024. So in summary on Chart 12, our solid first-half results give us confidence in raising the full-year outlook for sales, profit, and EPS, while holding the cash flow outlook, reflecting our ongoing efforts to deliver predictable, and improving operating and financial performance as is expected of us. It all starts with a relentless focus on executing to our programmatic commitments and delivering critical 21st-century security mission capabilities where we strive to continuously improve. To that end, we are investing in our people, processes, and systems through the 1LMX transformation, with the goal of unlocking step changes in efficiency, velocity, and program execution that delivers security capabilities in ahead of ready speed to our customers. And we're confident that these management priorities and actions convert to a compelling long-term value proposition for customers and shareholders alike. With that, Lois, let's open up the call for Q&A. Questions & Answers: |