CLEVELAND_CLIFFS_CLF Earningcall Transcript Of Q2 of 2024

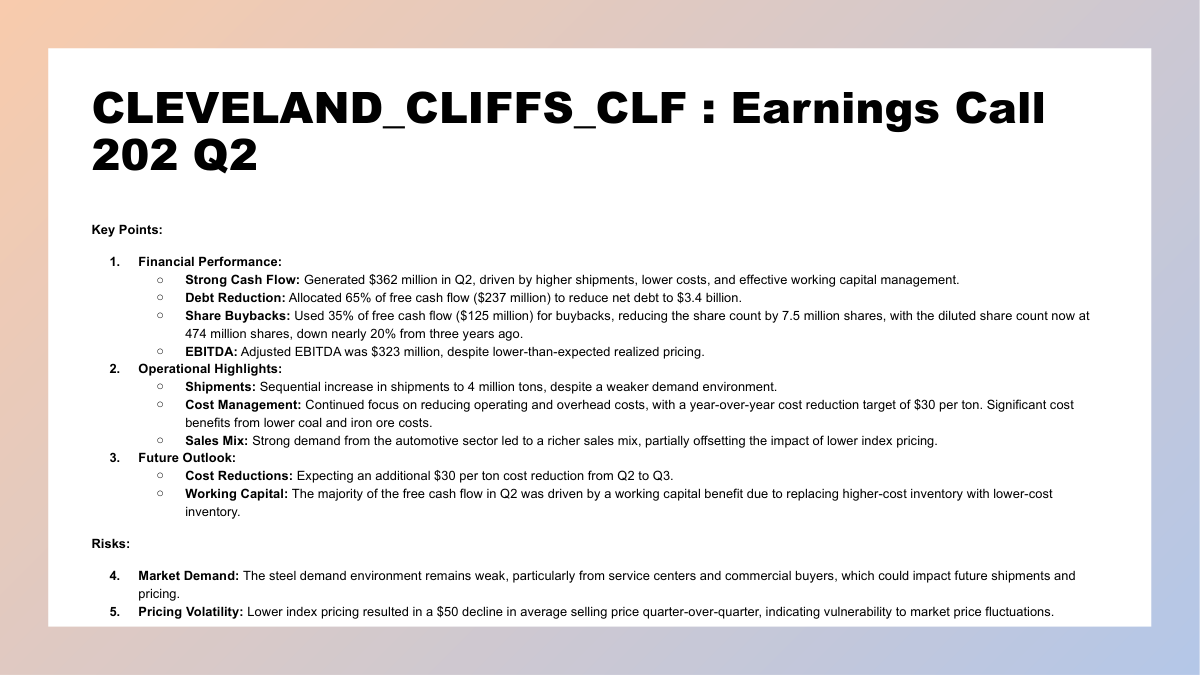

Celso Goncalves -- Executive Vice President, Chief Financial Officer Hey. Good morning, everyone. In Q2 we generated a strong cash flow of $362 million, driven by higher shipments, lower costs, and continued success in managing working capital and finished inventory levels. We allocated 65% of that free cash flow in Q2 toward reducing net debt by $237 million, bringing our net debt balance down to $3.4 billion. We used the remaining 35% of that free cash flow from the quarter or $125 million toward buybacks, reducing our share count by another 7.5 million shares. Our diluted share count is now at 474 million shares, down by nearly 20% from as high as 585 million shares three years ago. Notwithstanding the lower-than-expected realized pricing in Q2, we generated an adjusted EBITDA of $323 million, supported by the cost improvements we foreshadowed on last quarter's conference call. Importantly, our shipments were up sequentially back to the 4 million ton level, despite the weaker demand environment that we and other North American steel companies experienced throughout the quarter. The continued resilient demand for steel from our clients in the automotive sector, coupled with weak demand from service centers and other buyers of commercial grades resulted in a richer sales mix than expected. As a result, the impact of lower index pricing led to a $50 decline in average selling price quarter over quarter. Our operating and overhead costs continue to come down, and our guidance of $30 per ton in year-over-year cost reduction remains on track. You can already see this in our cash flow statement, as replacing higher-cost inventory with lower-cost inventory during the quarter drove the majority of the working capital benefit in Q2. This cost reduction is primarily a function of lower coal costs making their way through inventory and lower iron-ore costs from our mines. We expect another $30 per ton cost reduction from Q2 to Q3. This will help to partially offset the impact of low prices for spot sales captured by the indexes. The free cash flow we generated in Q2 was largely driven by a working capital benefit. We have systematically and consistently reduced our finished steel inventory over the past two years from 3.4 million tons at the start of 2022 down to 2.4 million tons currently. It was a great effort from our commercial and operations teams to achieve this, and there's even more opportunity to unlock more cash from inventory going forward. We were also able to reduce our capex budget for the year by $25 million, as certain projects have come in under budget. We will remain lean on capex even with our flagship Middletown project spend starting up next year. As a result of all these factors, we have proven that we can deliver great cash flow to our shareholders even in down-cycle pricing environments. Our SG&A expense was down a lot in Q2, a nearly $50 million reduction from the same period one year ago. The weak steel pricing environment has forced us to sharpen our pencils on all fronts when it comes to costs. And we are pleased with what we have accomplished so far, both at the operational and overhead level. These efforts will continue during the second half of the year. We're doing all the right things to achieve our target of improving our annual through-the-cycle EBITDA by over $600 million. In order to get there and regardless of the steel pricing environment, we keep ourselves committed to our five key priorities now and going forward. These priorities are as follows: Number one, reduce costs. We remain on track to meet our 2024 target with that momentum ultimately carrying us further -- to further reductions in 2025; number two, maximizing cash flow from automotive. We have the largest and most profitable automotive steel franchise in the Western Hemisphere. The reliable and consistent margins we achieved in automotive from fixed prices allow us to continue to generate free cash flow in any spot market downcycle, particularly in a strong market for automotive; number three, progress on value-enhancing projects, which once online will be a game-changer for both our cost structure and environmental footprint. We continue to advance our major projects in partnership with the U.S. Department of Energy at Middletown, Ohio, and Butler, PA along with our state-of-the-art transformer plant in Weirton, West Virginia announced yesterday. Number four, capital allocation. The structure of the Stelco deal will provide us several prepayable options to quickly deleverage, as we reprioritize cash accumulation and debt repayment. And number five, opportunistic M&A. At this time, Cliffs is laser-focused on closing the Stelco deal as soon as possible and getting to work on growing the value of the combined enterprise. As we have always done, we never let a weak market go to waste in identifying M&A targets and organic growth opportunities to improve our business. The North American flat-rolled steel market remains fragmented. Lourenco spoke last week about the industrial logic with Stelco acquisition. And from a financial standpoint, the transaction is meaningfully accretive to earnings, significantly improves our profit margins, and the financing strategy uses a combination of cash and stock that implies a pro forma leverage level that is lower than when we acquired AK Steel and ArcelorMittal USA. We'll be funding a portion of the acquisition with immediately prepayable debt instruments, which will give us the opportunity to delever right away with that enhanced free cash flow we pick up from Stelco. With that, I'll turn the call over to Goncalves. Laurenco Goncalves -- Chairman, President and Chief Executive Officer Thank you, Celso, and good morning, everyone. This past quarter was a great illustration that no matter how the market is doing, we are always in pursuit of opportunities to better ourselves. On our call last week, I spoke in great detail about the merits and logic of our acquisition of Stelco, and I will not repeat myself today. The transcript and recording of last week's call are available on our website for those who may have missed it. Today, I will focus on the actions we have taken since our announcement last Monday. We have engaged in discussions with all key stakeholders, including local union leadership. To all the USW-represented steelworkers of Stelco, we can't wait to start working with you soon. We have also been able in constant conversations with political leadership at the provision and federal level to advance a quick resolution and a quick closing. And we are grateful for the warm welcome we have encountered from everyone in Canada. It's clear to us that all key stakeholders recognize the net benefit we will provide to the Province of Ontario and to Canada. Ontario is a great place to do business and we are convinced that the acquisition of Stelco by Cleveland-Cliffs will further improve the natural connection and the healthy partnership between Canada and the United States. Alan Kestenbaum and team have made significant and relevant investments to set Stelco up for future success. The blast furnace reline just a couple of years ago and the coke plant upgrades, including a brand new 115 megawatts core generation power plant fueled by captured and reutilized blast furnace gas have made Lake Erie Works a very efficient steel plant, operating at a benchmark level in CO2 emissions. By now, smart investors know that efficient blast furnaces are not going away. The technology is superior now and we will gain an even greater advantage in flat-rolled steel production as more and more EAFs are built and fight over a shrinking pile of prime scrap. As the steel market improves, as it always does, Stelco will demonstrate its great potential. For reference, in 2021 Stelco generated over $1.5 billion in EBITDA with over 50% EBITDA margins, 5-0, 50% EBITDA margins. The market was not giving them the right for credit back then, and it still was not prior to our purchase. Stelco has a favorable cost structure. It throws off robust free cash flow even in pricing environments like the one we are in right now. End-user demand for flat-rolled products by and large is still pretty healthy. Yet certain service centers are drawing down inventory to below basement levels and not buying at low replacement costs, big mistake. By the time our acquisition close later this year, I expect the market will be a lot more rational and a lot more favorable to Cliffs, boosted by the addition of Stelco to our footprint. Back in August of 2020, we could not move hot-rolled even at $444 per net ton. Then within four months, we're back above $1,000 per net ton. I'm not saying that this is an exact parallel, but it shows that as long as the demand is there, which is things tend to look ugliest right before our sharp snap back. It's clear to me that we just need one small catalyst, whether that be a rate cut, certainty around the presidential election, trade enforcement, or something unforeseen right now, and that will ignite the rebound. One issue pending resolution is Mexico. Mexico continues to be a major problem in the marketplace. Mexico has long taken advantage of good phase trade agreements with the United States, such as NAFTA and its successor USMCA. Mexico's bad behavior has become even more egregious in recent years. We commend the U.S. government for their recent imposition of tariffs on steel trans-shipped through Mexico, which is particularly serious issue for flat-rolled steel. For too long, Mexico has enabled countries like China, Japan, South Korea, Brazil, and several others to get away with dumping steel into our domestic markets using Mexico as a trans-shipment ground with zero or no value-added. It's great to see action being taken, but we need a lot more. We fully expect that by the next reassessment of the trade agreement in 2026, regardless of being Kamala Harris, the President of the United States, or Donald J. Trump, the President of the United States, Mexico will be forced out of the USMCA by the United States and Canada. Cleveland-Cliffs continues to do well in the areas of specialized value-added steels, namely automotive-grade, stainless, and electrical steels. These three businesses are all performing nicely for us, especially since automotive sales and production levels remain at multi-year highs. The commodity index-linked side of the business is the final piece of the puzzle and we're confident that the Stelco acquisition will help us there. I want to shine a particular light on our gross grain-oriented electrical steel business that supplies the electrical transformer market. Electrical steel is just 2% of our total shipment volume, but was 15% of our total EBITDA in Q2. We are in the midst of an extreme shortage of transformers in this country. We have the ability to produce more GOES to meet these additional needs, but our current customer base is constrained in other areas of the supply chain and by lack of labor. For more than a year, we have been asking our GOES customers how we can help them improve their production levels. The one thing they always point to that's hold them back is labor. The production of transformers is an incredibly labor-intensive process. This is where we took two separate problems and created a solution. As you may recall, due to the incomprehensible action taken by the International Trade Commission, rejecting the imposition of the tariffs recommended by the Department of Commerce on unfairly traded tin plate imports, we had to take our Weirton, West Virginia tin mill down earlier this year. While we were able to relocate over 100 of the impacted workers, we still had a large pool of more than 600 USW-represented highly skilled manufacturing professionals eager to get back to work. With our Weirton plant only about 70 miles away from our Butler, Pennsylvania GOES production facility, we had a great solution. By building our own transformer plant, we accomplished the goals of increasing demand for our GOES, moving into supply -- supply and transformers to a very undersupplied and high-margin market for transformers and with that, bringing approximately 600 employees back to work. We are incredibly grateful for the State of West Virginia for recognizing the opportunity right away and for putting their full support behind us. We will receive one-third of the total project cost of $150 million to repurpose the plant in the form of a $50 million grant from the state with a net investment by Cliffs of $100 million. With the ongoing trend on electrification and the growing adoption of electricity-heavy artificial intelligence, I can't think of a better business move than the production of electrical transformers, particularly high-demand pad-mounted transformers that currently sell for $10,000 a piece for a single-phase up to $300,000 a piece for a larger three-phase unit. We expect the plant to come online in the first half of 2026. The building and the basic infrastructure are in place and it is a matter of ordering and installing equipment. In the meantime, we will be bringing in the house the proper expertise to make this one the most efficient plant in the world, made in the USA by union workers with a cost advantage of controlling the steel input. We thank Governor, Jim Justice and his team for working with us on this important project. We will make West Virginia proud. Furthermore, during the quarter, we announced new carbon emissions targets. This came after achieving our previous 25% reduction target eight years ahead of schedule. I will repeat, eight years ahead of schedule. We are now committed to reduce Scope 1 and Scope 2 Greenhouse Gas Emissions by another 30% by 2035, from our 2023 baseline with a long-term target aligned with the Paris Agreement's 1.5 degrees Celsius scenario. This reduction will be driven primarily by our projects at Middletown, Ohio, and Butler, Pennsylvania, each one developed in cooperation with and with financial support from the U.S. Department of Energy. As we have discussed, these types of projects do not just provide very significant environmental benefits but also enable substantial cost benefits, particularly the one at Middletown Works. Business environments like the one we have been through lead to earnings that do not reflect our full potential. That said, our investors can take comfort that current Cliffs is by no means a finished product. The seeds we have planted during the first half of 2024 are setting the stage for a much more efficient, diversified, and competitive company in the near future. Just in the last six months, we have announced two high-value accretive capital projects with federal government support. Advanced further downstream with the construction of a transformer plant, this one with the state legislature and state government support, and announced the acquisition of Stelco, the lowest-cost rolled -- cost flat-rolled producer on the North American continent. The benefits of these initiatives compounded over time will be immense. The great work we have done on improving our balance sheet over the past two years has allowed us to put all of these initiatives in motion. As I approach my 10th-year Anniversary as CEO of Cliffs in a few weeks on August 7th, I am as energized as ever about our prospects as a company. For Cleveland-Cliffs, the best is yet to come. With that, I will turn it over to Darryl for Q&A. Questions & Answers: |

Cleveland_cliffs